Get the free due date for form 1120 for 2019

Show details

A Form 2290 must also be filed once a vehicle is placed in service. The due date for each month is the last day of the following month. For example if a vehicle been stated in the following table for tax year 2014-2015. E-file Form 2290 for just 9. 90 for a single truck with http //www. expresstrucktax. com Vehicle First Used Month Due Date Jul 2014 9/2/2014 Aug 2014 Sep 2014 10/31/2014 Oct 2014 Nov 2014 Dec 2014 2/2/2015 Jan 2015 Feb 2015 3/31/2015 Mar 2015 4/30/2015 Apr 2015...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your due date for form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your due date for form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing due date for form 1120 for 2019 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit amazon form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

How to fill out due date for form

How to fill out due date for form:

01

Start by locating the designated field for the due date on the form. It is usually labeled clearly as "Due Date" or something similar.

02

Enter the specific date that the form is due in the format specified. Make sure to follow any guidelines provided, such as using a certain date format or including the time if necessary.

03

Double-check your entry to ensure accuracy. Review the date you entered to make sure there are no errors or typos.

Who needs due date for form:

01

Individuals submitting the form: If you are filling out the form as an individual and submitting it to someone else, including a due date is important. It sets a deadline for when the form needs to be submitted, ensuring timely processing and reducing the chances of delays or missed opportunities.

02

Organizations or institutions: When organizations or institutions require forms to be filled out, they often stipulate a due date to streamline their administrative processes. By setting a due date, they can better manage the influx of forms and allocate resources accordingly.

03

Regulatory bodies or government agencies: In some cases, forms may need to be submitted to regulatory bodies or government agencies. These entities may specify a due date to meet legal or compliance requirements. Meeting the due date is crucial to avoid penalties or consequences for non-compliance.

Fill 2290 late filing penalty : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file due date for form?

The due date for filing a form can vary based on the type of form and the individual or entity required to file it. The specific due dates for each form are outlined by the relevant tax authority or government agency.

For individuals in the United States, the due date for filing federal income tax returns (Form 1040) is typically April 15th of each year. However, this date may be extended if the 15th falls on a weekend or holiday.

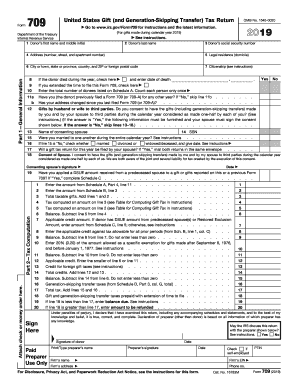

For businesses, the due date for filing various forms, such as Form 1120 for corporations or Form 1065 for partnerships, can vary. Generally, these forms are due on the 15th day of the third month following the end of the tax year (e.g., March 15th for calendar year filers).

It is important to consult the specific instructions for each form or seek advice from a tax professional or accountant to determine the correct due date for filing.

How to fill out due date for form?

To fill out the due date for a form, follow these steps:

1. Read the instructions: Make sure you thoroughly understand the form and any guidelines provided. Look for specific instructions on how to enter the due date.

2. Identify the due date field: Locate the field on the form where the due date is supposed to be entered. It may be labeled as "Due Date" or something similar.

3. Format the due date: Determine the required format for the due date. Some forms may ask for a specific date format like MM/DD/YYYY or DD/MM/YYYY, while others might provide a drop-down menu or calendar tool to select the due date.

4. Enter the due date: Input the due date in the required format. If the form offers a drop-down menu or calendar tool, select the appropriate date.

5. Double-check the filled information: Review all the entered details on the form, including the due date, to ensure accuracy. Correct any errors if necessary.

6. Submit the form: Once you have completed filling out all the required fields, including the due date, verify that the form is fully filled out and error-free. Then, submit it following the provided instructions, whether that means electronically submitting it or mailing it in accordance with the given guidelines.

What is the purpose of due date for form?

The purpose of a due date for a form is to establish a deadline by which the form needs to be completed and submitted. This ensures timely processing and enables the organization or individual receiving the form to effectively manage their workload and adhere to any applicable timelines or regulations. The due date helps eliminate delays, promotes efficiency, and allows for better planning and organization of resources.

What information must be reported on due date for form?

The specific information that must be reported on a due date for a form can vary depending on the type of form and the reporting requirements. However, some common information that may need to be reported includes:

1. Personal or business identification: This can include the name, address, and social security number or employer identification number.

2. Financial information: This can include income, expenses, deductions, credits, and any other relevant financial data.

3. Employment information: This can include wages, tips, and other compensation received from an employer.

4. Investment information: This can include dividends, capital gains, interest income, and other investment-related data.

5. Health or insurance information: This can include details about health coverage and any related tax implications.

6. Legal or regulatory information: This can include information related to legal situations, such as bankruptcy, foreclosure, or other tax-related issues.

It is important to consult the specific instructions and guidelines provided for each form to ensure accurate and complete reporting.

When is the deadline to file due date for form in 2023?

The deadline to file federal tax returns in the United States for the tax year 2022 (not 2023) is typically April 15th. However, if April 15th falls on a weekend or holiday, the due date may be extended to the next business day. Please note that tax deadlines can change, so it's always advisable to consult the IRS website or a tax professional for the most accurate and up-to-date information.

How do I execute due date for form 1120 for 2019 online?

Filling out and eSigning amazon form is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How can I edit due date w 2 2019 on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit pay 2290 with credit card.

Can I edit semalt com on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share 2019 irs 2290 forms from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

Fill out your due date for form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Due Date W 2 2019 is not the form you're looking for?Search for another form here.

Keywords relevant to 2290 watermark form

Related to 2018 form 2290 tax

If you believe that this page should be taken down, please follow our DMCA take down process

here

.